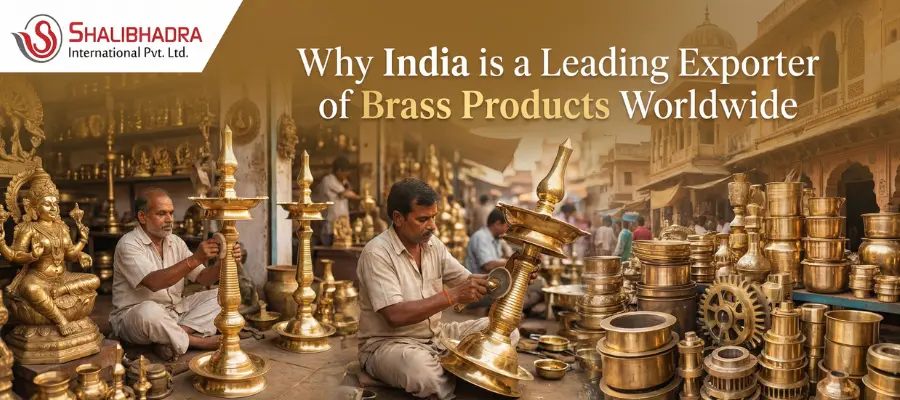

From bustling workshops to quiet village studios, India sends finely made brass goods across oceans. Buyers everywhere seek pieces that last, choosing intricate lamps or solid plumbing parts without hesitation. Tradition shapes each item, yet modern demand guides how they’re sold abroad. Growth hums quietly through these exchanges, linking distant economies one shipment at a time.

For global importers, finding a reliable Brass Products supplier Factory India has become a priority as demand shifts toward consistent quality and long-term value.

Brass Prices Rise Amid Growing Demand

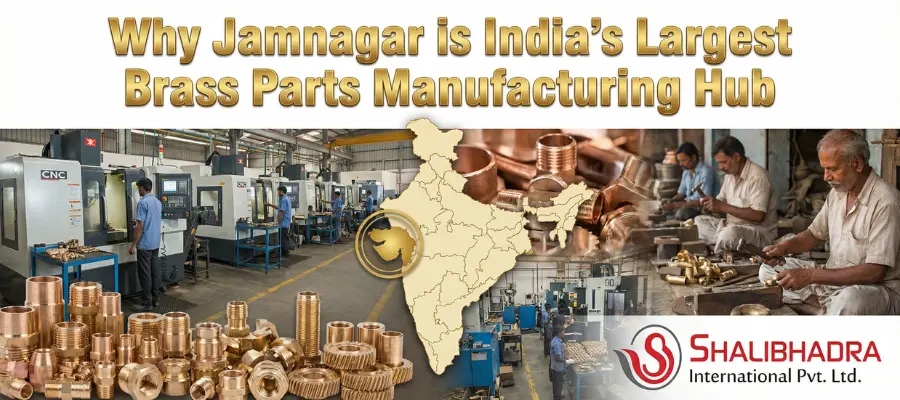

A surge in India’s brass exports saw nearly $1.12 billion earned in just four months through July 2024 – up more than 30% compared to last year. Leading the charge, Jamnagar supplies most of what gets made across the country, shipping goods far and wide to well over a hundred nations. During the fiscal stretch from March onward, exporters moved close to three-quarters of a million separate loads. That count hit five thousand six hundred fifty in February – not bad for one month, actually showing growth since the prior year by around eleven points.

First place goes to the United States, bringing in large volumes of decorative items along with machinery components. Close behind are China, then Thailand, Italy, and Germany – not far off the pace. Across the Atlantic, the UK has ramped up its intake sharply; recent data shows nearly 66 thousand consignments over one year, hitting 5,531 just last February – a clear upward slope of nearly eight per cent.

Rising steadily worldwide, the need for brass pushes forward at more than ten per cent each year. Valued at under eight billion dollars recently, it is on track to cross fifteen and a half billion within six years. A major slice of this activity flows through India, where goods resist rust while also looking good. These products line up neatly with strict rules from Europe, Japan, Britain, and Switzerland, making Brass Products Supplier Factory India a trusted option for buyers who want fewer compliance issues.

Home demand gives it a boost. India’s brass industry hit $526.68 million in 2023, aiming for $711.81 million by 2030, growing steadily at 4.60% each year, thanks to building projects and handmade goods. Supplies arrive from Africa along with the USA, flowing into well-organised production hubs.

Craftsmanship That Captivates

From village workshops to sprawling factories, Indian makers shape raw brass into delicate crosses, detailed vases, and sturdy industrial rods. In Jamnagar alone, more than five thousand units blend handcrafted touch with advanced machinery. These spots craft wiring, joints for pipes, parts under car hoods, all built tougher than similar goods elsewhere.

This is where a Brass Products supplier, Factory India, stands out. What makes these factories special is how well the metal carries current, forms smoothly during shaping, and lasts for decades when recycled.

Filigree bowls from Moradabad find their way into American and European houses, glowing under quiet lights. Lamps shaped by local hands carry either aged textures or smooth modern glimmers, built exactly how buyers want them. Tough layers resist wear, lasting years even when treated roughly. Fewer replacements mean steady savings for overseas buyers.

Indian Brass in High Demand Across Key Global Markets

What drives demand? American appetite never slows when it comes to buildings and interiors. Over in Europe, a shift toward sustainability gives recycled brass an edge, especially in water systems and electric vehicles. Factories across Asia rely on low-cost components, especially as production spreads beyond China into places like Thailand. German and Italian buyers insist on precision-made connections. Growth ticks upward year after year in the United Kingdom.

Even with shipping delays, exports held strong, up 8 per cent in the UK by February 2024. Because of trade deals, more doors opened. Now, 2,468 sellers reach 7,010 customers worldwide, most of whom work directly with a Brass Products supplier in India to secure better pricing and stable delivery schedules.

Buyers notice the difference. Indian brass lasts longer and costs 20 to 30 per cent less than alternatives on average.

Buyers See Potential in India

Pricing takes the lead here. Thanks to Jamnagar’s affordable workforce and nearby materials, costs stay low without hurting standards. Handwork wins over mass factory output seen elsewhere. Each piece follows strict checks that prove it meets global rules. Shipments move steadily through trusted routes, reaching deadlines even across complex borders.

When it comes to sealing agreements, green methods matter. A modern Brass Products supplier, Factory India, often runs on recycling loops and low-waste systems, fitting today’s worldwide standards. Suppliers also adjust metal mixes with precision, which builds long-term trust with importers.

Here is how the math plays out. Buying ten thousand connectors from India might cost twenty thousand dollars, while another source asks for twenty-eight thousand. Because Indian brass lasts a fifth longer, each customer saves about sixteen thousand dollars every year. Over time, that adds up quickly.

Jumping Obstacles, Catching Chances

When metal prices move fast, sellers feel the pressure. Still, smart planning keeps most operations steady. Shipping around the Red Sea has slowed routes, but Indian ports adapt quickly. Even with higher US import duties, quality keeps doors open in other regions.

Looking ahead, demand for conductive brass in electric vehicles could double before 2030. Research into new alloys continues to push performance higher. Online marketplaces now link buyers directly with every major Brass Products supplier, Factory India, cutting out layers of cost and delay. Government support through Make in India keeps the momentum moving forward.

How Buyers Can Succeed

Factories near Jamnagar are ideal for large orders. Always ask for material samples before finalising. For customs clearance, HS code 7418 helps move decorative and fixture items faster. Discuss minimum order terms early since volume can shift prices.

Join virtual trade fairs and supplier meetings to stay ahead. Prices often dip after major holidays, which makes timing important. One importer reported a 40% profit jump after switching sourcing to a Brass Products supplier Factory India.