Some of India’s metal workshops rank among the planet’s most trusted exporters, shaping markets with skilful work and steady output. Buyers based in America, across European nations, the Emirates, and elsewhere head straight to these production centres when they need strong pipe parts, detailed handmade items, or exact engineering pieces. For many global importers, choosing a Brass Product Exporter Factory in India has become the smartest route to quality without inflated pricing.

Inside this full overview lies everything necessary: where key industrial zones sit, which manufacturers lead the field, how procurement unfolds, what expenses arise, rules to follow, plus shifts ahead – giving clarity for smarter decisions and better returns.

The Unrivalled Appeal of Indian Brass Factories

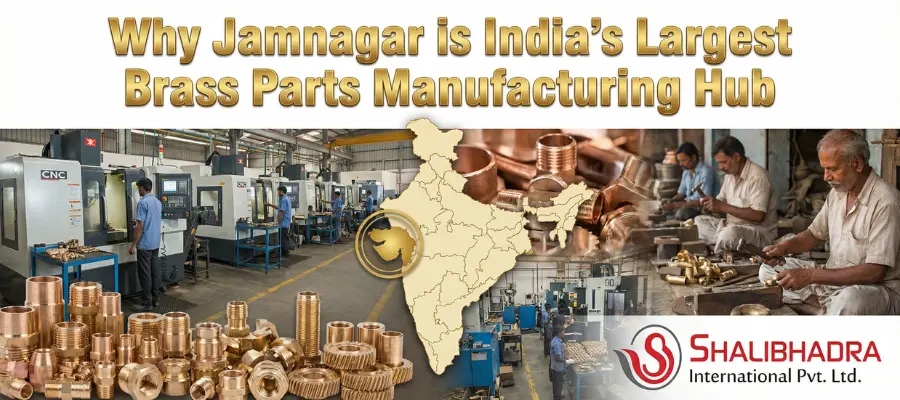

What explains India’s top spot in brass exports? Old-school metal know-how meets modern machinery, turning out items like rust-proof bars alongside detailed lighting fixtures. From one city, Jamnagar, comes nearly all of that production, sending out over a billion dollars’ worth by early 2024, up more than three-tenths. Shoppers gain through lower prices, often saving between a fifth and a quarter compared to Europe or China, while ordering small batches, sometimes just five hundred pieces. This is exactly why buyers continue shifting to a Brass Product Exporter Factory in India for both volume and custom orders.

Delivery shows up in about a month and a half. Factories follow standards such as ISO 9001, ASTM B36, WRAS, CE, UL, CSA, and RoHS, so goods work well in plumbing, cars, wiring, and design. What matters most is sustainability: a lot of them reuse old materials, cutting emissions without losing that 99.9% pure quality. With companies looking beyond China, a Brass Product Exporter Factory in India stands out thanks to steady politics and nearly two and a half thousand exporters ready to ship. Think about supply chains differently? A buyer in the US saved more than one-third by switching production to Jamnagar, suddenly seeing much better profit.

Strategic Factory Hubs Across India

Fifty kilometres west of Ahmedabad sits a city where metal hums day and night. Not far from train tracks, workers shape rods meant for electric vehicles. Some factories stack coils taller than men. Craftsmen north of the Ganges hammer delicate patterns into dinnerware before shipping overseas. Each curve was etched by hand under dim bulbs. In sprawling urban clusters near the capital, taps and couplings roll off assembly lines fast. Coastal workshops twist alloy tubes that others cannot replicate. A quiet town in Odisha carves out thin profiles for obscure machinery. Foundries here do one thing well, no banners, no websites, yet many of them operate as a serious Brass Product Exporter Factory in India behind the scenes.

Factories near Mundra get raw copper and zinc straight off ships. These materials move directly into processing units that refine and finish products. Some buyers check operations through online tours instead of visiting. Others prefer seeing things at events such as the IHGF in Delhi. Being close to the port means shipping expenses drop sharply. A single facility can deliver goods to the UAE within ten days, another reason why working with a Brass Product Exporter Factory in India keeps logistics simple.

Elite Brass Exporter Factories in Focus

Fresh off a wave of growth, Sanlak runs sleek factories making metal bars, flat sheets, and coiled strips, alongside tailor-made blends for gadgets and boats. Moving beyond borders, their goods reach buyers across Europe and the Western Hemisphere, backed by relentless quality checks and around-the-clock service teams.

The top spot often goes to Hindustan Brass Industries, where rods, fittings, and hardware flow from years of building on steady work. Close behind stands Deepak Brass Industries, where the US, UK, and UAE get certified plumbing and electrical parts, tested under UL and CSA rules. Each of these operates as a high-capacity Brass Product Exporter Factory in India, handling both bulk shipments and precision parts.

Fifty years ago, a company began shaping parts that squeeze pipes tight. Quality checks there follow global rules, plus water-safe standards suit small test orders. Another workshop focuses on clean-system joints, built for food or medicine flow. A third draws custom tap designs using computer sketches. Some factories push out tons of metal sleeves every month. Tubes coded 7412 move fast through their lines. Big names like Rajahs, Shree, National, Kriya, and Manan keep those streams full.

From India, Brass World handles OEM orders just right. Shree Brass Industries makes brass parts that fit into plastic items in huge volumes. Across oceans, Ishita Brass moves goods while caring about cleaner production. Together, they serve more than seven thousand customers, proving how large a Brass Product Exporter Factory in India network has become.

Diverse Product Range Examined

Far from just making parts, factories handle rods, wires, and fittings under HS 7418. Car hardware marked HS 7318 is another zone they cover. Craft items under HS 7419 also roll out in bulk. Valves for pipes and fittings for drinking water are produced by specialists like Jain, who supply lead-free brass. Sanlak focuses on DZR mixes built to fight zinc loss.

Out back, teams tune material to resist corrosion, add polished coatings, or engrave designs into metal. Since the pandemic, clinics prefer antimicrobial brass without lead. One workshop now produces electric vehicle charging plugs in just fourteen days, pushing how fast a Brass Product Exporter Factory in India can respond to modern demand.

Learn sourcing one step at a time.

Start by checking sites such as IndiaMART, Trade India, Alibaba, and Compass. Look for export history and certifications.

• Shortlist suppliers and request quotes with full material specs

• Samples cost between fifty and three hundred dollars and arrive within a week

• Test strength and corrosion resistance

• Review machines and waste handling

• Negotiate FOB or CIF with 30 per cent advance

• Begin with a thousand units before scaling

Rigorous Vetting Checklist

Ask for ISO and ASTM certificates. Verify shipping data. Request recent production reports. Check response time. Read buyer feedback. Companies with five-plus years of export history and more than a hundred buyers usually outperform.

Detailed Cost Analysis and ROI Calculation

Five thousand units often cost between five and ten thousand dollars. Ten thousand units bring prices down further. Shipping to the US adds about ten to fifteen cents per unit. Import duty adds two to five per cent. Final landed cost is still nearly a dollar lower than the Chinese supply.

Every ten thousand units saves about ten thousand dollars. A longer lifespan saves another twenty thousand per year. ROI often triples within twelve months.

Managing Logistics, Payments and Rules

Freight moves via Mumbai or Mundra. Payment uses LC or wire. Products must meet RoHS, EU REACH, and NSF lead-free standards. Insurance covers 150 per cent of the cargo value. UAE shipments benefit from zero duty.

Emerging Trends and Pro Tips

Automation speeds production. EV demand increases brass use. Recycled alloy usage rises sharply. Trade fairs like GIFA and online buyer networks help secure better rates. Early 2026 pricing remains stable for now.

Shiny results come from India’s brass workshops. Working with the right Brass Product Exporter Factory in India puts buyers in control of cost, quality, and supply. Once that connection is made, growth follows naturally.